Shop FSA & HSA Eligible Protein & Supplements

Naked Nutrition has partnered with Truemed to allow you to use your Health Savings Account (HSA) or Flexible Spending Account (FSA). This means you may be eligible to buy your favorite Naked products with pre-tax dollars, resulting in net savings of 30-40%.

Naked Nutrition Is Now FSA and HSA Eligible

FSAs and HSAs were created for you to spend tax-advantaged dollars on products and services that can alleviate or prevent specific medical conditions, and TrueMed is making it easy to do just that. All you have to do is add products to your cart, select TrueMed as your payment option at checkout, enter your FSA or HSA debit card, and take a quick health survey to determine eligibility.

The Truemed payment option determines eligibility and enables qualified customers to pay with their HSA/FSA funds in checkout. Once you’re approved, that’s it! You’ll receive an order confirmation and effectively save 30-40% on your order!

Truemed is for patients for whom the selected product has been proven to prevent or reverse a condition you care about. An asynchronous health evaluation will determine eligibility and take qualified patients to payment.

If you pay with your HSA/FSA card, there's no other work you need to do (we'll send paperwork to ensure compliance). If you pay with your personal credit card, we'll send reimbursement instructions.

How It Works

Add products to your cart

Please ensure all items are “one-time,” as we cannot accept HSA/FSA cards for subscription purchases at this time.

Verify payment

Ensure you are not signed into "Shop Pay" and don't use any accelerated checkout options.

(Ex: Shop Pay, Google Pay, Apple Pay)

TrueMed Payment Option

Select TrueMed as your payment option at checkout

Complete

If you pay with your HSA/FSA card, there's no other work you need to do (TrueMed will send paperwork to ensure compliance). If you pay with your personal credit card, TrueMed will send reimbursement instructions.

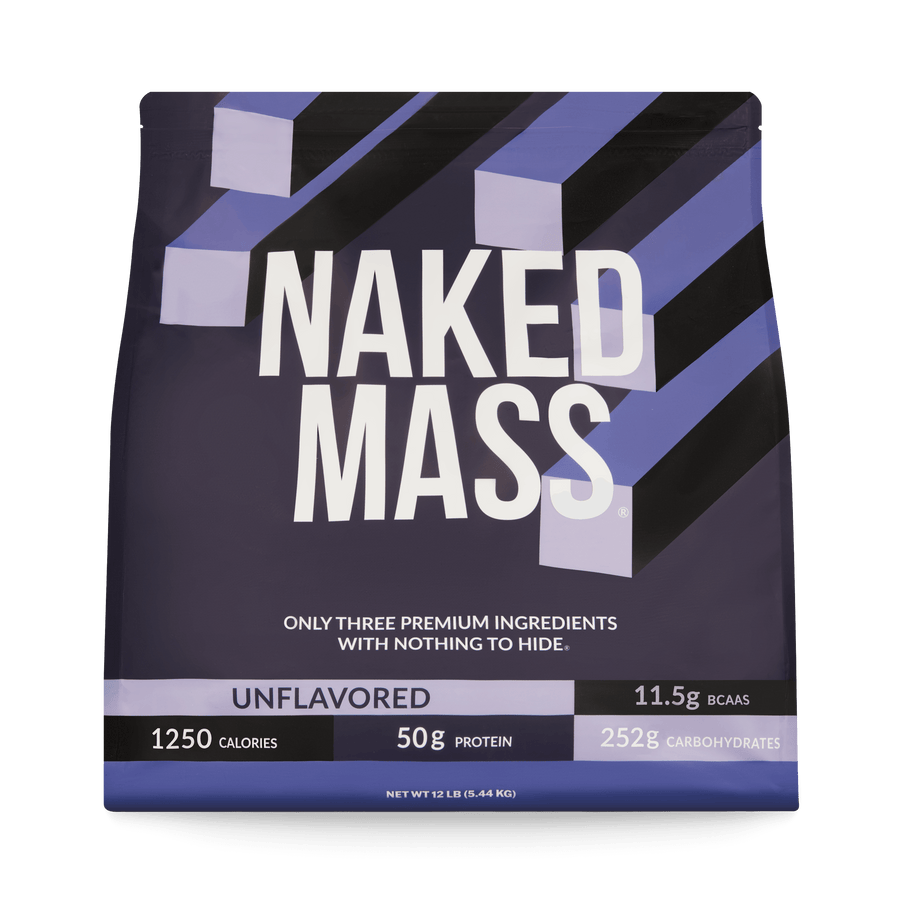

Shop FSA Eligible Products

we source the best ingredients, use as little of them as possible, and leave out the junk.

At Naked Nutrition, we prioritize transparency over marketing gimmicks. We offer products with only the purest ingredients, ensuring you know exactly what you're putting in your body.

Shop All

GMO Free

No Added Sugars

Gluten Free

Soy Free

Third Party Tested

Vegan Options

As Seen On

Health

men's journal

spy

observer

bicycling

Health

men's journal

spy

observer

bicycling

Health

men's journal

spy

observer

bicycling

Most Popular

Frequently Asked Questions

Overview

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) are tax-free accounts that can be used to pay for qualified health expenses. These accounts are usually set up and managed by an HSA or FSA administrator, and you should have access to said HSA/FSA administrator through your employer (ask your HR department!).

HSAs are typically associated with a high-deductible health plan, and funds do not expire. FSAs are independent of your health plan, and funds elections occur in October-November each year for the following calendar year. FSA funds expire every calendar year.

Unfortunately, HSAs and FSAs are not available outside of the US, and self-employed individuals (who do not have an HSA from a previous employment) do not qualify for HSAs or FSAs.

Truemed partners with merchants and brands to enable qualified customers to use HSA/FSA funds on qualified products and services that are used to treat, mitigate, or prevent a diagnosed medical condition. Truemed partners with a network of individual practitioners who evaluate customers’ eligibility and issue Letters of Medical Necessity to qualifying customers, thereby saving customers money on legitimate medical expenditures.

Truemed is backed by best-in-class investors, including functional medicine pioneer Mark Hyman and founders from Thrive Market, Eight Sleep and Levels.

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

An individual can contribute up to $3,850 pretax to their HSA per year, or $7,750 for a family (plus an additional $1,000 if you are at least 55 years old Individuals can contribute up to $3,050 pretax to their FSA per year (with an additional $500 in employer contributions allowed). Almost every qualified individual will save between $1,000 and $2,000, depending on their state and tax rate.

In order to determine whether certain products or services are legitimate expenses for treating, mitigating, or preventing a diagnosed medical condition, HSA/FSA plan administrators often require a letter from a licensed practitioner. This letter is called a “Letter of Medical Necessity.”

Using your HSA/FSA funds on eligible products or services sold by Truemed’s partner brands can result in significant savings. HSA/FSA accounts allow you to use pre-tax dollars to purchase products and services to treat, mitigate, or prevent the specific medical conditions that you have been diagnosed with.

Unfortunately, Truemed’s services are for individuals who have HSA or FSA accounts (or plan to fund one during open enrollment). We encourage you to ask your employer about information on your HSA or FSA!

Unfortunately, Truemed is currently only available in the United States.

Truemed Process

Yes! You can use your HSA/FSA card. Once you pay with your card and complete the survey, all you need to do is keep an eye out for the Letter of Medical Necessity that we will send you, and hold onto it for the next 3 years.

If you prefer to use your regular credit card, you are welcome to do that and we will send you instructions for how to submit for reimbursement from your administrator.

Generally it takes 24-48 hours. If you aren’t seeing your letter in your inbox, check spam, then reach out to us at [email protected] for help!

If you do not qualify, you are able to reapply for HSA/FSA spending at a later date.

HFA/FSA Account Questions

You can occasionally request a split invoice from the merchant that you are making a purchase from, but like your normal bank account, you generally need to have the funds to cover the purchase to avoid a rejection.

Please contact us at [email protected] so we can help you troubleshoot the issue. HSA/FSA plan administrators often have detailed requirements, so it may be as simple as re-issuing your Letter of Medical Necessity using the administrator’s form.

For most Americans, open enrollment is in the last four months of the year. Simply elect to increase contributions to your HSA or FSA during this time and you can begin shopping with Truemed merchant partners. Starting on January 1st, qualified individuals will be able to spend their entire HSA or FSA amount on products that a licensed practitioner recommends to treat, mitigate, or prevent a specific, diagnosed medical condition. These funds will be pulled from your paycheck, prior to tax withholding, by your HSA/FSA administrator in equal installments through the year.